|

For those of you who don't know me, I am quite obsessed with Sherry Lansing, former CEO of Paramount Pictures, the first woman to ever head a Hollywood movie studio (when she became president of production at 20th Century Fox), and a highly successful independent film producer (where she was responsible for such hits as Fatal Attraction, Indecent Proposal, and more).

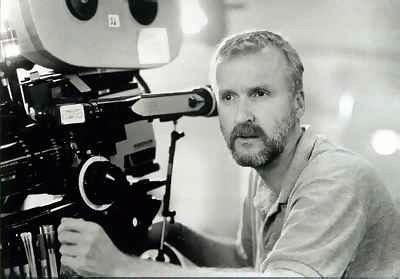

I already wrote an entry about Sherry and her thoughts about money. Basically, she is a super conservative investor as her theory is - "I've worked hard for my money. I'm not going to gamble it away." Sherry was right to be conservative. The movie industry is a tough place to work, and you are only as good as your last hit. You have too many financial flops, and you're out. Sherry also subscribes to the "money is freedom" theory. "From the time I started making money at Fox -- I was 35 - I always wanted to save to have enough so that I didn't have to worry," Ms. Lansing said. "If you ever need a job, you will always do the safe thing because you will be scared. The only way you can perform in a job is if you don't need it. Then you can make pure decisions that are not based on fear." James Cameron, the movie director, has some different ideas about money. He subscribes to the theory of "I'll always be able to make money no matter what happens" and is willing to take more gambles. As Vanity Fair said, he really is a man of extremes. What else could you expect from a truck driver / school janitor who decided one day that he wanted to be a film director and then ultimately ends up making movies like Terminator, Titanic, and Avatar? This particular story illustrates Cameron's attitude toward money. When Cameron was making Titanic, the budget was initially set at ~$110 M and was funded by 20th Century Fox. The budget proceeded to skyrocket while in production, with ~$3-$4 M being spent every week, and ultimately, the budget ended up at ~$230 M. Paramount Pictures stepped in and offered $65 M in funding, with the stipulation that any profits be split 50/50. It was an extremely difficult production and at one point, Cameron offered to give up his directing fee and potential profit points, which meant that he would give up any profits he would make if Titanic became a hit. 20th Century Fox never took him up on the offer because they were convinced that Titanic would be a flop (perhaps at best, it would break even) and in doing so, Cameron walked away with upwards of $100 M when Titanic did turn out to be a smash hit. Now think about this - Cameron had worked on Titanic for three solid years, 7 days a week (he took a day off to get married to his 4th wife, Linda Hamilton). By giving up his directing fee and potential profit points, he basically would have worked for free all those years. Cameron certainly wasn't poor - he had made some money off Terminator 2 and True Lies. But in his mind, he thought that maintaining his integrity and good relationship with 20th Century Fox was much more important than the money he would have made, especially considering how out of control the production budget got. Cameron is someone who truly loves making movies and I believe that while the buckets of money he made was a generous byproduct of his work, money was never his primary motivator - making a great movie was. I believe that after Sherry achieved F*** You money as well (she made this after Fatal Attraction became a monster hit), she still kept working because she loved making movies too. So here's my main takeaway from these two very interesting people: 1) Find an industry to work in that genuinely interests you 2) Make sure you are paid decent money 3) Save and invest as aggressively as you can 4) Think about the life choices you make and how those choices can affect when you become financially independent (when you have enough money that you don't ever have to work again and can pretty much spend your days doing whatever you want) 5) Operate your life without fear

Comments

Comedian Maria Bamford has an interesting Wealthsimple interview where she talks about making money as a comedian.

Some commenters on Jezebel broke down her numbers and it looks like she earn ~$312K / yr (after taxes and assuming she performs every week). If she is only performing 3/4ths of a year, she earns ~$234K / yr. And that's just from stand-up shows. This doesn't include all her other income streams (voiceover work, TV shows, etc). Not bad for a comedian. Contrast Maria Bamford to the entertainers struggling to make a living detailed in Gaby Dunn's very well-written article "Get rich or die vlogging: The sad economics of internet fame." Having thousands of social media followers or subscribers doesn't necessarily translate to big bucks. Unless you have a trust fund or some other source of income, "being popular" doesn't really pay the bills. And if you can't pay the bills, forget about saving or investing. As I mentioned, I worked in startups before business school and see a lot of similarities between the two industries. There are a few people who really hit it big and cash out. (And Maria Bamford isn't necessarily "cashing out"; she's just doing quite well for an entertainer). The majority don't. I thankfully realized this early on and realized the "slow and steady" approach was much more suited to my temperament. The only advice I can offer to people who want to make it as entertainers is to keep your day job. Having a stable day job is great! You get a steady salary, health insurance, 401k benefits, and more! Save and invest your money. Think carefully about how you want to live your life so that you can achieve financial independence early and THEN possibly pursue becoming an entertainer full-time. Who are you and how old are you?

I am a male in my late 20s in my second year of business school. Tell me about your background. I grew up in the South, went to college in the area, and then moved to Los Angeles and began working in the entertainment industry. I worked at a digital media startup that was later bought by a really large entertainment company that you’ve definitely heard of. The digital media startup was founded by someone who had a lot of success making movies back in the day and wanted to get into the digital media space. He’s very well-connected and raised a lot of money for the startup. Unfortunately, the company really didn’t go anywhere - it didn't make much money and is what you would call a “zombie startup” - one where there’s no growth but it’s not dead either. The company had plenty of cash but because it didn’t really show explosive growth, it didn’t make much sense to keep the startup going after a while. He ultimately got this large entertainment company to acquire the startup. I stayed on for about a year after that and then decided to go to business school in LA. I learned a lot from this experience and plan to continue working in the startup space after graduation. I interned at a very cool startup over the summer and plan to go back to this company after graduation. What does your financial situation look like? If you don’t earn money through a “normal job”, how do you support yourself? At the moment, I’m not making any money because I’m in business school. I wasn’t able to save a whole lot when I was working in the digital media startup so I have a lot of business school loans. The startup that I plan to work at after graduation will pay me a decent amount but it won’t be as much as I would make if I became an investment banker or consultant. The overall salary is in the high five figures but I was given equity in the company. My fiance (who I met in business school!) will actually work as a consultant after we graduate and she said that she would be fine supporting me during the first few years. How do you define rich? I define rich as having $30 million in my bank account. I’ve lived in LA for a long time and there are a lot of trust fund kids running around. Some are very industrious - they use their trust fund money to fund various ventures and I’ve always thought that having $30 million would set me up for life. I’d have enough to live a really nice life but also enough to fund various startup ventures. Did you grow up with money? How did your childhood conditions about money affect how you behave? I grew up in a middle to upper income household. My dad was a lawyer and my mom was a high school teacher. They taught me the basics of money but never harped on it in any way. I think they thought I would just figure it all out on my own. Did your parents give you money when you were growing up? What about for school? My parents paid for my college so I am very lucky in that respect. That’s what gave me the confidence to move out to LA and work at a startup. My post-grad plans would have been a lot different if I had school loans to pay off. Unfortunately, they are not paying for my MBA. Do you still have school loans? I will have about $200K in business school loans when I graduate. Where did you learn about investing? I haven’t really looked into investing other than what I’ve read in random news articles. It looks like robo advisors are really popular so I’ll probably open up an account with one of these. I’d like to start investing but it doesn’t look like that will happen for a while because I have to pay off my business school loans! What does your family situation look like? I recently got engaged over winter break to my fiance. Other than that, I have an older sister who works as a lawyer back home in the South. Do you and your spouse/partner have similar financial habits? My fiance likes to spend a bit more than I do but it’s not out of control in any way. She just enjoys the finer things in life and given that she’s always had a high-paying job (and will continue to make lots of money as a consultant), these are things she can afford. I wouldn’t really call myself a frugal person (meaning I don’t use coupons or anything like that) but I’ve always made less than her so I can't spend as much. What was your most regrettable purchase? I don’t have a single regrettable purchase but I spend way too much on takeout. I really need to cook more at home. It’s just that with my work schedule before business school, I’d never have time to make lunch or dinner and so I was always eating out. I have more time in business school to cook in our apartment but I still spend too much on things like Starbucks coffee in the morning and expensive dinners. I recently created an account on mint.com and was really shocked by how much I spend every month on food. What was your best purchase? My plane ticket out to LA after college. I really wanted to leave the South and move to LA to work in entertainment. I don’t ever plan to leave and hope that I’ll have a great career in this town! Do you feel like you have a financial habit that’s out of the norm (or at least something that others have commented on)? I don’t think I have one. Maybe I spend a lot of money on takeout and that’s abnormal? I don’t think so though. Most of my friends spend just as much as I do if not more so I don’t think it’s weird. Do you feel like your success now has anything to do with luck or being in the right place at the right time? Yes, I think there was a lot of luck involved but also hard work. When I moved out to LA, I applied for a ton of different entertainment jobs. I got the digital media startup job relatively quickly because they had just started at the time and needed smart people to staff the office. I’ve stayed there for a few years, met some great people and enjoyed the work even though the startup wasn’t a massive success. When I look back, I realize how unusual my situation was - the only reason we were in business for so long was because the company had so much capital simply due to the founder’s name and reputation. Most startups in our situation would have gone under after 1-2 years because they would have run out of money. The founder wrote a recommendation for me for business school and I think that helped me get in. I also got my summer internship because one of the co-founders of this startup is an alum of my business school. He gave a presentation in one of my classes and we talked afterwards. He pretty much just offered me an internship right there and then. Do you feel like your lifestyle reflects your income bracket? Probably not. I’m not making any money now and I have a lot of school loans to pay off. Yet I’m still spending money like I have a high-paying job. I think it’s the business school culture - there’s a lot of pressure to go on ski trips and go out to dinner, all that stuff. A lot of students here are also very wealthy and that contributes to my spending habits. Do you talk to your peers and family about money? I talked with my fiance about it when we were deciding whether I should go back to this startup after graduation. Sometimes, I'll talk with my parents. Do you worry about money? Not really. I’ve never had money issues before and I think I’ll be okay in the future. Do you splurge on anything? If so, what was the last splurge and how much was it? There was a big ski trip over winter break and I spent about $2500 on that. It covered flights, our lodging, dinners, all that. Do you have a plan to make more money? I hope I’ll continue to do well with my job and make more money that way! Anyone who knows me personally knows that I look up to Sherry Lansing, previous CEO/President of Paramount Pictures and successful movie producer.

I recently reread this 1995 NY Times article that I had kept bookmarked in my browser for the past few years. It's an article where Sherry discusses her financial situation and her thoughts about money. The biggest surprise for me is how frugal and normal she still is after having such massive career and financial success. I think her attitude is admirable and something we should all keep in mind for our financial futures. Some tidbits from the article worth repeating: Even today, having accumulated an ostrich-sized nest egg of tens of millions of dollars from producing hits like "Fatal Attraction," "Black Rain," "Indecent Proposal," "The Accused" and "School Ties," Ms. Lansing is still leery about her financial future. Her film credits may reflect a passion for high-voltage drama, but when it comes to investing, the last thing she wants is a thriller. She has nothing against investing; she just won't do it unless she knows all about what the money is being invested in, and she believes that is generally impossible. Film she knows. "If I take a risk with a film," she said, "I know every in and out." But outside the movie business, "I don't know enough," she said. "I worked hard for my money. The idea of turning it over to someone else to manage and putting my fate in their hands is inconceivable. I know my business, but I never thought I knew anyone else's business. And I am not a person who likes to abdicate control of my financial interests." The only exception to her Treasury bills and CD's is a big wad of stock in Viacom Inc., the owner of Paramount, where she has been since 1992. "I want to sleep well at night," she said over breakfast at the St. Regis. Her Hollywood uniform hinted at both her success and her caution: a conservative brown Armani pants suit, with a black turtleneck and high heels. "I have enough money, and I don't want to worry about it." What made Ms. Lansing such a wary investor? No trial and error was involved. She set her course when she made her first killing in Hollywood, back in 1980, when she was already president of production at 20th Century Fox. When the investor Marvin Davis bought the company in 1981, "We had stock options and he bought everybody out in one fell swoop," Ms. Lansing recalled. She won't say how much she made, but associates put the figure at several million dollars. "I remember thinking, 'What should I do with it?' " Ms. Lansing recalled. Soon afterward, she was at dinner at Elaine's restaurant, a New York favorite for media moguls, with Mo Rothman, a veteran film executive who owned the rights to Charlie Chaplin's film library. Mr. Rothman, a gruff, outspoken man who has known Ms. Lansing for years, told her: "Why don't you pretend you've made half of it, because the rest is what you pass on in taxes. Put it in CD's and you will sleep very well at night, knowing your money is safe." At that time Mr. Davis, who had made a fortune in the oil business, "was putting lots of people into oil deals," Ms. Lansing said. But she ignored such high-flying ideas, instead following the advice of Mr. Rothman and other friends. It was a seminal decision, she said. In a telephone interview from London last week, Mr. Rothman recalled: "She has always been worried about money. She was a girl alone, a single girl. She didn't know if she would be fired or get another deal -- all the preoccupations that women are worried about when they are alone in the world." During a brief stint as an actress in the soap opera "Loving," she started offering suggestions on the script to Ray Wagner, the producer. That led to a job reading scripts for him for $5 a hour. From there she worked for a talent agency. She moved on to MGM, where she ultimately became president for creative affairs, and to Columbia, where she was senior vice president for production. But even as her salary soared, Ms. Lansing worried. "I had been in the business and I had watched the ups and downs," she said. "I had seen people who were big-salary people. They lived high on the hog, and they did not prepare for the future. And one day it stops for everybody. This is a very tough business, tough and cruel. When I was a reader and story editor, I watched what happened to people. I watched how cruel people were to them when they couldn't get jobs. "I can give you 20 examples of people who did not prepare for the future, and then one day the salary stops, the hit movies stop. They lose everything, including their self-esteem." For Ms. Lansing, money was freedom. "From the time I started making money at Fox -- I was 35 -- I always wanted to save to have enough so that I didn't have to worry," Ms. Lansing said. "If you ever need a job, you will always do the safe thing because you will be scared. The only way you can perform in a job is if you don't need it. Then you can make pure decisions that are not based on fear." Friends say that when Ms. Lansing turned 50, she began to believe that she ought to be able to live it up more. After all, she had the money. Because Hollywood is hardly the home of low-key living, she wondered whether she had a problem about spending. She even consulted a psychiatrist about becoming a chic shopper. He asked her what she liked to own and, presumably, was reassured when she told him she liked abstract art -- an expensive choice. He urged her to go out and buy something she liked so they could study her reaction. Ms. Lansing took herself to the Knoedler Gallery in New York. As one friend recalled it, "she zoomed through the gallery, said she wanted a particular painting by Helen Frankenthaler and bought it in 16 seconds. They had probably never seen anything like it." But Ms. Lansing soon discovered that she didn't care much about collecting expensive art. Looking at it in other people's homes was good enough. "All I could think was that the money would be better used if I gave it to charity," she said. Finally the therapist dismissed her. Regardless of whether she was normal by Hollywood standards, he concluded that she was happy nonetheless. To be sure, she does live well. "Don't get me wrong," she said. "I live in a house, not a garret. I'm not a bag lady. I am sitting in a beautiful hotel room. I have a beautiful suit on. Of course I like making money very much. But there is a limit to the things I think are worth buying. There is nothing that I want to buy that I don't have." Ms. Lansing said she had already had an influence on her husband's (movie director William Friedkin) spending habits, if not his approach to investing. They do have his-and-hers business managers and do not discuss specific investments with each other, but their disparate life styles are coming together. When they married, Mr. Friedkin had five homes: a house in Aspen, an apartment in New York, a house in Big Bear, Calif., one in Los Angeles and a second that he was building. "I said, 'What do you need an apartment in New York for? That is the stupidest thing. I don't want to live in that apartment that you lived in with your other wives, and I don't want to do it over. Wouldn't you rather have the money? We can stay at the St. Regis or the Peninsula.' " He bought the life style script. They now own just one house, the one in Beverly Hills, which they bought together. "He was the exact opposite of me," Ms. Lansing explained, but now, she says, he is coming around to her way of thinking. "Billy's attitude toward money is much different from mine. He is an artist. He takes no responsibility. Because he takes no interest in money, he spends it. If you tell him not to spend it, he doesn't." Who are you and how old are you?

I am a 28 year old currently working as an assistant to the showrunner of a well-cast TV show that will be airing next year. Tell me about your background. I grew up on the East Coast and stayed in the area to go to college. Since college, I've worked as an Executive Assistant at various show business companies and as a Production Assistant on both the set and in the office. I've also been an assistant to various movie/TV directors, producers, and writers (some of whom you've definitely heard of). What does your financial situation look like? If you don’t earn money through a “normal job”, how do you support yourself? I've been working in the showbiz industry for the last six years. I still haven't gotten my "big break" but have been steadily employed since college. At the moment, I am working as an assistant to the showrunner of a TV show that will be airing next year. Even though I don’t feel like I’m making that much, my costs are paid for during the week - my meals are paid for and I received a rental car that I drive to and from work. Even though I'm not making huge amounts of money, I'm lucky in that I have a lot of money saved up. When I had my Bar Mitzvah back in 2000, I received some money which has been since sitting in an investment account and has compounded over time. I don't touch that money. Also, when I was 25, I got some inheritance money from mom’s parents who passed away. During my first two jobs out of college as an executive assistant, I lived at home with my parents but commuted to my job, and so I was able to save up quite a bit of money that way. By the time I moved out and to the city, I had a considerable amount saved up. During short stretches of time when I wasn't employed, I received unemployment insurance money. How do you define rich? This is very subjective to me - rich and poor people define this in different ways. I'd say that it’s when you don't have to worry about everyday things. Did you grow up with money? How did your childhood conditions about money affect how you behave? I had a very comfortable upbringing in an upper/middle class family. My dad is a doctor and my mom is a homemaker. My mom previously worked an electrical engineer but stopped working when she had me (and my two siblings) and hasn’t worked since. When I was growing up, my dad worked 6 days a week and it wasn't until I was around 13 that he cut down to only working 5 days/week. I've never felt poor. We always went on family vacations, and I got toys that I wanted. I really never thought about money but then again, I’ve always been a low-maintenance guy. When I was growing up, I didn't really want anything. You know how when you're young, you come up with huge lists of what you want for your birthday? The older I got, the harder it was for me to think about things because I just didn't want anything. Did your parents give you money when you were growing up? What about for school? I got weekly allowance of around $5 - $10 at one point for doing chores. My parents paid my entire college tuition and room/board. I didn't take out any financial aid. Do you still have school loans? No Where did you learn about investing? I don’t know very much about investing. I defer to my dad and his accountant to deal with this. His accountant just asks me what my risk tolerance level is, and invests money accordingly. My risk tolerance level is very low! I always ask him to put things in low-risk accounts. I am okay with not touching money for many years. What does your family situation look like? I am currently single, living in the city. Do you and your spouse/partner have similar financial habits? I have been dating someone new for a few months. She and I have very similar financial habits in the sense that she is not a big spender and also very low maintenance. On date night, we are fine staying in watching a Netflix movie and eating takeout. We're certainly not going to fancy steakhouses during the week. The net worth of my girlfriend doesn't matter to me. If I were looking to get married, I would want my wife to have similar financial habits and be in a good financial position. When/if you have children, will you put money away for their college tuition? It's not something I've something I’ve thought about. But yes, at the point when I have children, I'd hope that I'd have a more financially stable life and and pay for their entire undergraduate education. Do you feel like you are living paycheck to paycheck? If so, do you feel that way due to your lifestyle? No, absolutely not, even though I don't make huge amounts in my job. I don't feel that way simply because I have a lot of money saved up and live way below my means. For example, I could live in a much nicer apartment than I do now and not have roommates, but I really don't mind my current living situation. What was your most regrettable purchase? I can't really think of anything since I don't buy much! It would be really small things like I bought a gift for a girlfriend but we broke up before we could use it together, or I lost my umbrella and then bought another one but then I found that first umbrella, small things like that. What was your best purchase? I believe it's better to spend money on experiences than on things. My best "experiential" purchase probably has to be a cruise I went on with my girlfriend a few years ago on the west coast. We justified it by saying that we were already out on the west coast for a wedding and why don't we just go on the cruise since we're already in the area. Do you feel like you have a financial habit that’s out of the norm (or at least something that others have commented on)? I spend a lot less than people in my age group even though I have a lot saved up. I live below my means - I'll always buy a $5 burger than a $15 burger and get mad if I have to pay more for something than necessary. Do you feel like your success now has anything to do with luck or being in the right place at the right time? Yes and no. My philosophy is that luck is nothing more than what happens when preparation meets opportunity. One example I can give you of being in the right place at the right time is that once, I was an office Production Assistant for a TA show. I overheard that the director (he is very famous and you've definitely heard of him) was looking for an assistant and I immediately volunteered to do the job. I got it, and ended up working as his assistant. I liked him a lot and it was a great experience. I’m successful in the sense that I’m working in the industry that I want to be in, but I'm worried that I won’t get to where I want to be because of how competitive this industry is. Do you actively contribute to a retirement account of any sort? No, not at the moment. Retirement seems so far away that I haven't given it much thought. Do you talk to your peers and family about money? I don’t talk to my peers. I talk to my parents, mainly my dad, since he's the one in charge of money in the household. I don’t really talk to my siblings about money other asking them what they're paying for rent. Do you worry about money? I think everyone does, even the richest people. My personal worries are very trivial, such as "How much money should I spend on dinner tonight." Do you splurge on anything? If so, what was the last splurge and how much was it? I rarely splurge on anything. My last splurge was a 2-week trip to Europe over the summer. I spent the first week with my siblings and we had a great time - we explored major cities (Oslo, Norway was so expensive!), stayed in hostels, and were very reasonable about our costs. I probably spent around $1000 that first week. During the second week, my parents came out to travel with us and pretty much paid for everything. Do you have a plan to make more money? Not explicitly. I really hope that I will continue to move up to better positions and make more money through work. What would it take for you to feel like you are completely rich? It’s all relative. I reading reading that once you make $70,000/year, everything after that is gravy. I would like to make enough at a point where I just don't have to worry about money. And hey, I could always marry into money! That goes both ways. Have you ever seen that Stanley Kubrick movie Barry Lyndon? The main character marries into wealth and takes his wife's last name. He's a really terrible guy, though, so obviously not someone to look up to. In terms of money, what was something you did in the past that you could do differently? I don’t have any regrets - I've always been careful about how I spent my money. What is your strategy for moving forward now in regards to your big goals in life? I want to keep working, be proactive in my work, volunteer for assignments that come up, and demonstrate my value as a worker and as a thinker. |

What is this?

An anthropological look at how people think about money. Created and edited by Star Li. Archives

December 2022

Categories

All

|

RSS Feed

RSS Feed