|

I'm a big Jodie Foster fan and in several interviews that she's done, she talked about how when she was younger and working as a child actress, people would say to her, "Jodie, you'll be completely washed out by the time you're 40 and you won't ever work again after that."

Well, Jodie did keep working after age 40, but she was smart and did the following: she started to produce and direct movies, and she was smart about saving and investing her money early on!! She DIVERSIFIED her life portfolio. I just read this absolutely fascinating NYMag post where an anonymous entertainment accountant talks about her super famous clients and how surprisingly clueless they are about money. Lesson of the post: As an entertainer, you might hit it big, but it won't last forever. Stock away your money because the hits will stop one day. And when they do, you won't be struggling because you were smart early on and have enough money to live on for the rest of your life! "My clients are actors, musicians, writers, newscasters, directors, models, and producers, many of them Grammy and Academy Award winners ... It’s insane, because they don’t live in the real world. They don’t understand anything about how normal, everyday stuff works. Why do you not understand that because you made 1 million, 5 million, 10 million this year doesn’t mean you’re going to make it next year, and the year after! For god’s sake! You can enjoy yourself, but take a percentage of it and put a little bit of money away! And if you have a mortgage, pay down the principal. Try to build up some actual equity in your home. If you have children, create a small trust fund for them. I think in all these years, I’ve had a total of two clients who have retirement funds. Only two. Some of them have investment accounts, but they’ll set them up in the “up” years, then, as soon as the bookings drop or they don’t work or the show they’re on is cancelled, they go through that money like water because they refuse to scale back their life style. We will say, “Guys! You need to cut back.” “Oh, I can’t cut back.” Yes, you can. “You want me to stay at Motel 6 and shop at Target?” No. But real people live on the amount of money they have coming in. They live within their means. I’m sorry, but I think most people could live comfortably on a million dollars! But for some reason, they can’t. They think they’re going to be famous and rich forever. You try help them onto the right path. It’s a weird the satisfaction you get when you can help someone else get financially set up and secure for life. Most of them are surrounded by people who tell them they can do no wrong so it takes a strong person to come through all that and be levelheaded and down-to-earth."

Comments

I am currently 28 years old and one of the things I often ask myself is - "If my 38 year old self came to visit me, would I be happy and/or impressed with what she has done with her life?" Pretty much every single major life prediction I've made in the past has been incorrect so I don't bother making predictions anymore. But, there is something I'm sure of - the more financially secure you are, the better off you'll be.

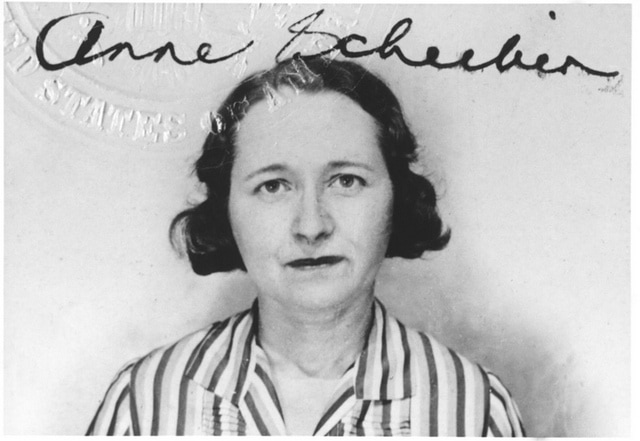

Thus, I'm going to ask the following: Think about where you'd like to see yourself in 5 to 10 years, and think about what action steps you can take NOW to achieve your goals. Your plans will almost certainly change and unexpected things will pop up. But if have enough money, you will always land on your feet. What are some examples of how being diligent and smart with saving and investing TODAY help you in the FUTURE? 1) If you lose a job because the robots have taken over, you'll have a safety cushion. 2) If a relationship ends, you'll have a safety cushion. 3) If an unexpected emergency pops up, you'll be able to attend to it without suffering any financial setback. 4) If you suddenly decide that you want to film a documentary about plant life in the Amazon jungle, you'll have the financial resources to do so. 5) You can spend money on your family and best friends. That is a major plus for me! Saving and investing now is relatively simple - have a portion of your income be automatically deducted and distributed into a savings / investments money bucket. Ignore any previous excuse you've used to not save and invest. After a while, you won't even notice the change in your lifestyle. And you'll certainly be in for a nice surprise in the future when you realize how much your money has grown thanks to the intelligent actions you took today and thanks to compound interest. Okay, I'm done sounding like your mom. Go forth and invest! I just discovered something really cool. Did you know that you can contribute up to $53K to your 401K every year, $35K of which can be transferred to your ROTH IRA? The $5.5K limit doesn't necessarily have to apply after all! Here's how it works: 1) You contribute up to $18K to your 401K (pre tax money) 2) Your employer kicks in the company match (pre tax money) 3) Depending on your employer, you can then contribute a certain percentage of your annual salary to your 401K after tax money bucket. Once a year, (if your employer allows), you then do an in-service withdrawal by transferring your 401K after tax money to your ROTH IRA. You may not receive a tax break with Roth IRAs (since contributions are made with after tax money), but earnings and withdrawals are generally tax-free. This is called the Mega Backdoor ROTH IRA. The College Investor has a more detailed explanation. FYI, this is different from the Backdoor ROTH IRA, which allows you to contribute $5.5K to your ROTH IRA even if you earn above the income limit. I'll let you know if I ever learn of a MEGA STUPENDOUS SUPER TOTALLY AWESOME BACKDOOR ROTH IRA. Apparently, only 10% of US companies allow employees to do both steps in #3 so this isn't something that everyone can do. But you should check! My investment accounts now look like the following: 1) Managed investment account with a robo-advisor 2) ROTH IRA account with a robo-advisor - this should look turbocharged from now on! 3) 401K account (with both pre tax and post tax money) 4) Health Savings Account ($3,400 max now but if the new Republican American Health Care Act passes, this could be increased to at least $6,550 for individuals). Being financially responsible feels pretty great. And if anything happens, I'll just remember that there's always money in the banana stand! I just read about a woman named Anne Scheiber, a so-called "regular" woman who amassed a fortune through investing.

After retiring in the mid 1940s from the IRS, Anne invested her $5,000 of savings into a portfolio that ended up being worth ~$22 million around her death 50 years later in the mid-1990s. Anne was apparently a recluse - "She lived quietly in her rent-stabilized studio apartment on West 56th Street that was bereft of luxuries: paint was peeling, the furniture was old and dust covered the bookcases. She walked everywhere, often in the same black coat and matronly hat. Ben Clark, her lawyer, said she never had a sweetheart and seldom went out, except to visit her broker." I'm not going to lie - Anne kind of reminds me of myself. I'm not a recluse but I definitely live a very minimalist lifestyle. And I invest like crazy. I'm like one of those people on that TV show Hoarders except instead of hoarding things, I hoard money. I don't even like to travel all that much - I prefer car roadtrips across America instead of international travel. For me, it's the company that matters more than what we're doing. I have no idea if anyone told Anne to live it up. If I knew her, I'd probably tell her that. But I'd tell her to do it in a reasonable manner - maybe upgrade her living space, dine out at nice restaurants, all that. Don't move to Vegas and start dropping $20K every night. I'm glad she was able to donate her fortune to Yeshiva University (after I pass away, my money will be donated to cat shelters and organizations that focus creating bionic eyes) but it would have been great if she had some fun with her money. Maybe she did and we just don't know it! In any case, it's certainly better to be smart with money management than to be mindless about it. If you are, don't forget to have some fun as well. You deserve it! As you're probably beginning to tell at this point, I am really interested in retirement financial solutions.

Sallie Krawcheck, the owner and Chair of the Ellevate Network (along with being the former president of the Global Wealth & Investment Management division of Bank of America and former CEO of Citigroup's Smith Barney unit) is launching a digital investment platform built specifically for women called Ellevest. Sallie wrote an interesting post talking about why she decided to do this. She is a big proponent of research and understanding human behavior - why do women approach investing differently? How can I fix this problem? I personally use Betterment to invest my money. I signed up 2.5 years ago and have never looked back! I'm interested in learning more about Ellevest when it launches, and encourage you to check it out! |

What is this?

An anthropological look at how people think about money. Created and edited by Star Li. Archives

December 2022

Categories

All

|

RSS Feed

RSS Feed